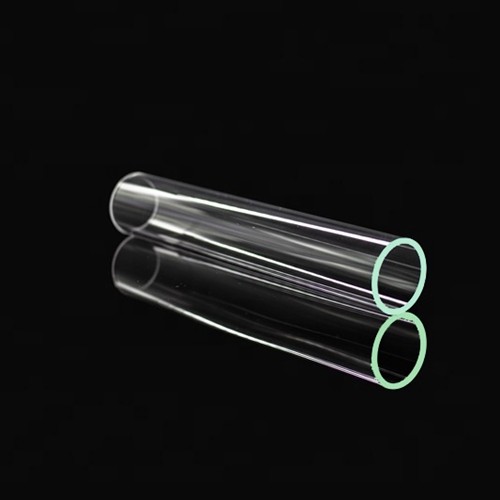

Soda Lime Glass, the Backbone of Everyday Glassware

The Global Soda Lime Glass Market is projected to grow from USD 95.54 Billion in 2023 to over USD 139.80 Billion by 2029 at a CAGR of 6.69%.

Carbon steel remains an integral part of industrial development across the globe, playing a vital role in construction, transportation, and heavy machinery. As one of the most widely used alloys in the world, its applications are as diverse as the industries it supports. From building structures and ship hulls to automotive bodies and pipelines, carbon steel is known for its high strength, excellent durability, and relatively low cost, making it the go-to material for engineers and developers alike. With global infrastructure investment on the rise and the need for efficient, sustainable materials growing stronger, the carbon steel market is undergoing a significant evolution. It’s not just about strength anymore—it's about innovation, cost-efficiency, and environmental adaptability. This growing relevance places carbon steel in a strategic position to drive modern industry while also adapting to future environmental and performance demands.

One of the strongest trends shaping the carbon steel market today is its increasing demand across infrastructure development and urban expansion projects worldwide. The Asia-Pacific region continues to lead the charge, with countries like China and India channeling massive public and private sector investments into building roads, bridges, and housing projects. Reports suggest that over 50% of global steel demand originates from the construction sector, a number largely dominated by carbon steel applications. A significant portion of this growth comes from urbanization and the rise in megacities, where low-cost yet high-performance materials like carbon steel are indispensable. At the same time, the automotive sector is undergoing a transformation driven by lightweighting trends and fuel efficiency mandates. Manufacturers are increasingly turning to advanced carbon steels to deliver improved crash performance, reduced vehicle weight, and lower emissions. Additionally, the manufacturing sector, including tools and industrial machinery, continues to rely on medium to high carbon steel for enhanced toughness and durability.

The impact of this market surge is widespread, affecting various stakeholders from manufacturers and developers to consumers and policymakers. For steel producers, the growing demand creates an opportunity to invest in advanced processing technologies such as thermo-mechanical rolling and alloy micro-tuning, which improve the structural integrity and performance of carbon steel products. In the construction industry, carbon steel enables rapid project delivery due to its high weldability and formability. This translates into faster construction timelines and reduced labor costs, making it highly attractive in both developed and emerging economies. In the automotive sector, carbon steel helps manufacturers meet safety standards while controlling production expenses. Consumers benefit from this by accessing more affordable and safer vehicles, homes, and infrastructure. However, there are notable challenges—most significantly, environmental concerns surrounding traditional carbon steel production methods, particularly those relying on coal-powered blast furnaces. The industry contributes substantially to global CO2 emissions, prompting a shift toward electric arc furnaces that recycle scrap steel and reduce environmental harm. Nonetheless, the current reliance on fossil fuels remains a major hurdle. Companies are under increasing pressure to balance production growth with sustainable practices, and regulations worldwide are tightening in response to climate goals. Addressing these challenges will be critical for long-term viability, particularly as the demand for low-emission materials continues to grow.

The carbon steel market is segmented based on carbon content into low, medium, and high carbon steel. Among these, low carbon steel—or mild steel—dominates the market due to its exceptional versatility, ease of fabrication, and lower cost. It is extensively used in construction (reinforced bars, beams), automotive parts (chassis, body panels), and even household goods. Its formability makes it an ideal choice for welding and machining, especially where strength needs to be balanced with ductility. Medium carbon steel strikes a balance between strength and flexibility, used in manufacturing axles, gears, and shafts. High carbon steel, known for its hardness and wear resistance, finds use in cutting tools, springs, and high-strength wires. Demand for low carbon steel is particularly high in the Asia-Pacific region, where infrastructural megaprojects are surging. The drivers behind this dominance include the shift toward prefabricated construction, industrial automation, and the expanding scope of renewable energy installations that often require steel-based foundations and supports. Opportunities are rising in the renewable sector, with wind and solar energy infrastructure increasingly incorporating carbon steel for mounting systems, support frames, and turbine parts. Additionally, smart infrastructure and modular construction methods are creating new application fields for low carbon steel, especially where sensors and electronics are embedded in steel structures for real-time monitoring. With rising steel recycling rates and circular economy initiatives, the future for low carbon steel appears even more promising.

Looking forward, the carbon steel market is expected to evolve in response to both technological advancements and global sustainability goals. Innovations in metallurgy are leading to the development of high-performance carbon steel grades that offer increased strength-to-weight ratios and improved resistance to corrosion and wear. These advanced grades are likely to find applications in aerospace, defense, and electric vehicles—markets that demand both performance and efficiency. On the production side, the shift toward electric arc furnaces is set to revolutionize how carbon steel is manufactured. These furnaces not only reduce carbon emissions but also allow for more localized, scalable steel production using recycled scrap metal. The increased focus on green steel—produced using renewable energy and zero-emission processes—is likely to become a mainstream offering within the next decade, supported by both consumer demand and regulatory frameworks. Additionally, digitization and automation are transforming steel mills into smart manufacturing hubs capable of real-time quality control and supply chain optimization. As climate regulations tighten and material efficiency becomes a business imperative, carbon steel manufacturers will need to invest in clean technologies and data-driven strategies. Emerging markets in Africa, Southeast Asia, and South America are expected to fuel the next wave of growth, as governments focus on building roads, hospitals, and energy infrastructure. For stakeholders—whether producers, construction firms, or governments—the future lies in balancing performance, affordability, and environmental stewardship. Carbon steel, with its rich legacy and adaptive potential, is well-positioned to remain the backbone of global industrial growth well into the next generation.

See how you can up your career status

The Global Soda Lime Glass Market is projected to grow from USD 95.54 Billion in 2023 to over USD 139.80 Billion by 2029 at a CAGR of 6.69%.

The Polymer Filler market is anticipated to cross USD 71 Billion by 2029, increasing from USD 55.70 Billion in 2023. The market is expected to grow with a 4.29% CAGR from 2024 to 2029.

The global steel rebar market is projected to reach USD 333.61 billion by 2030, growing at a 4.78% CAGR from 2025 to 2030.

We are friendly and approachable, give us a call.

We are friendly and approachable, give us a call.